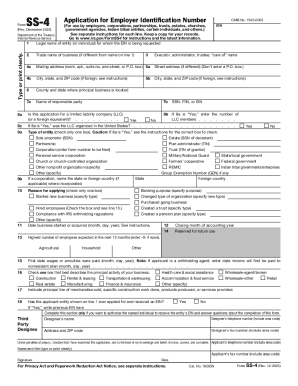

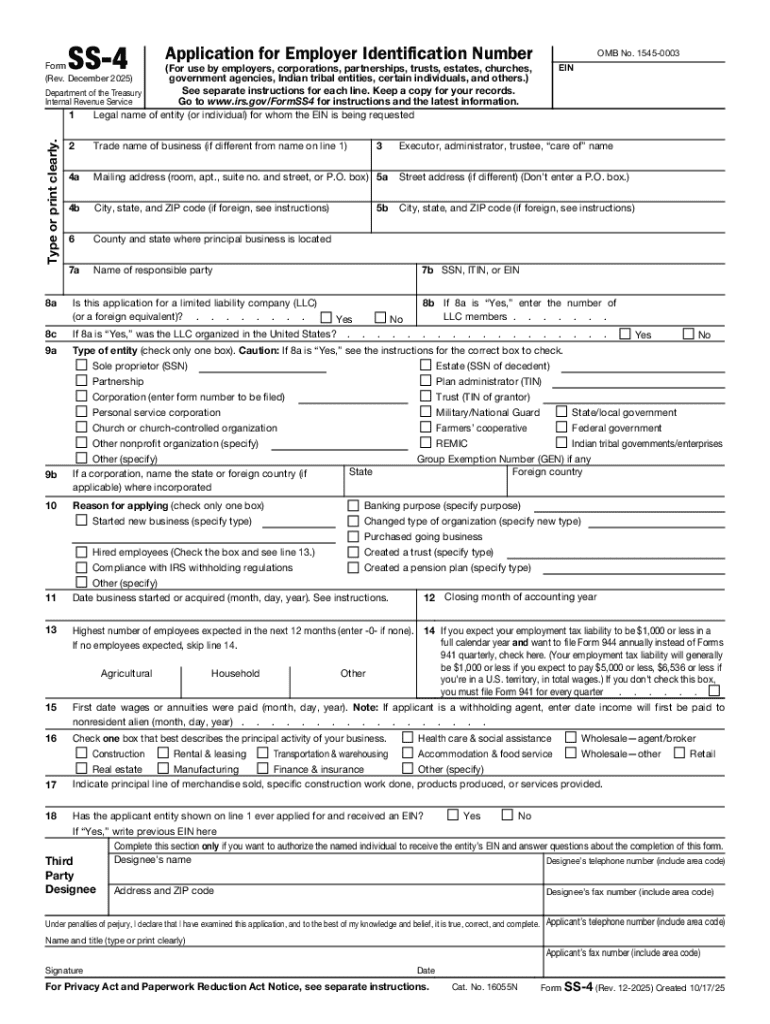

IRS SS-4 2025-2026 free printable template

Instructions and Help about IRS SS-4

How to edit IRS SS-4

How to fill out IRS SS-4

Latest updates to IRS SS-4

All You Need to Know About IRS SS-4

What is IRS SS-4?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

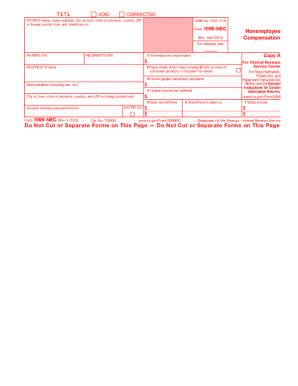

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS SS-4

What should I do if I realize I made a mistake on the IRS SS-4 after submission?

If you discover an error after filing the IRS SS-4, you can submit a corrected application. You'll need to indicate the correct information clearly and resubmit the form, along with any necessary documentation. Make sure to retain copies of both the original and corrected forms for your records.

How can I track the processing status of my IRS SS-4 submission?

To track your IRS SS-4 submission status, you can contact the IRS directly via their dedicated phone line for application status inquiries. Keep your submission details handy, as they will assist in providing you with the most accurate information regarding your application.

Are there any special considerations for nonresidents when filing the IRS SS-4?

Nonresidents must be cautious when completing the IRS SS-4, as there are specific requirements relating to their tax status and identification. It's advisable to consult IRS guidelines or seek professional assistance to ensure compliance with relevant tax regulations. Additionally, proper taxpayer identification numbers should be included.

What common errors should I avoid when filing the IRS SS-4?

Some common errors when completing the IRS SS-4 include incorrect taxpayer identification numbers, misidentification of applicant type (individual vs. business), and failing to provide all required information. Double-check your details to minimize the chances of rejection or delays in processing.

What steps should I take if I receive an IRS notice regarding my SS-4 submission?

If you receive a notice from the IRS about your SS-4 submission, review the notice carefully to understand the issue and gather any supporting documents required. Respond promptly within the given timeframe, and ensure that all requested information is accurate to resolve the matter efficiently.

See what our users say