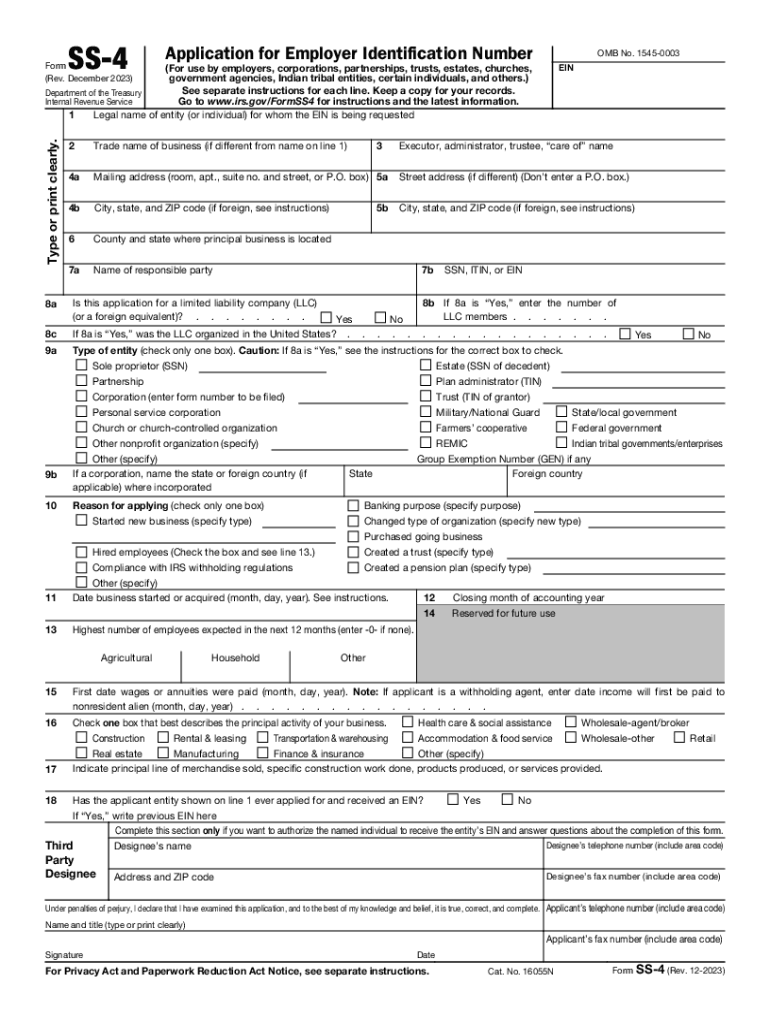

Who needs an IRS Form SS-4?

Application for Employer Identification Number labeled SS-4 form is the US Internal Revenue Service tax form to be used by employers, corporations, partnerships, trusts, estates, churches, government agencies, Indian tribal entities, single individuals, etc.

What is the SS-4 Form for?

This form should be used as an application for Employer Identification Number (EIN), which will be required for tax filing and reporting, similar to how individuals use Social Security Number (SSN) for tax reporting.

Is Form SS-4 accompanied by other forms?

The IRS SS-4 is self-sustained and doesn’t require any additional or supporting documentation.

When is IRS Form SS-4 due?

The fillable SS-4 form should be submitted upon the creation of a new taxable entity, for instance a corporation, partnership, trust, estate, church, government agency, etc.

How do I fill out the SS-4 Form?

The SS-4 form itself is a one-page requesting the following information:

The legal name of the entity applying for EIN

Address

Name of responsible party

Type of entity

Reason for applying

Entity's data (start date of business, expected number of employees, etc.)

Specification of work done or services supplied, etc.

Third party designee.

The second page of the form is an instruction that is supposed to help in filling the form out, if need be.

Where do I send the IRS Form SS-4?

Once the SS-4 is filled out, the applicant should direct it to the local IRS office, yet it is advisable t keep a copy for personal records.